Edit and apply VAT rate

From 1 January 2021, eBay will be legally required to begin collecting and remitting VAT for UK imports. From that date, eBay will have to charge buyers the applicable VAT amount directly and remit this sum to the relevant authorities.

UK sellers trading domestically and all sellers trading with UK buyers and listing on the UK or any EU site will need to provide both gross prices as well as the applicable VAT rate used to calculate the gross price on all listings.For all eBay UK listings (including direct delivery and overseas warehouse), the seller must provide the price including tax and the corresponding VAT rate used to calculate the price including tax, i.e. the price including tax = the price of the item * (1 + tax rate).

The Seller should complete the modification of the VAT rate in listings before January 1st, 2021.

Please click here for more info from ebay.

About VAT rates guidance on different goods and services from gov.UK, please click here.

Detailed operations

The VAT rate of listings can be edited and updated on the page, or using the table.

Ⅰ. Edit for single listing

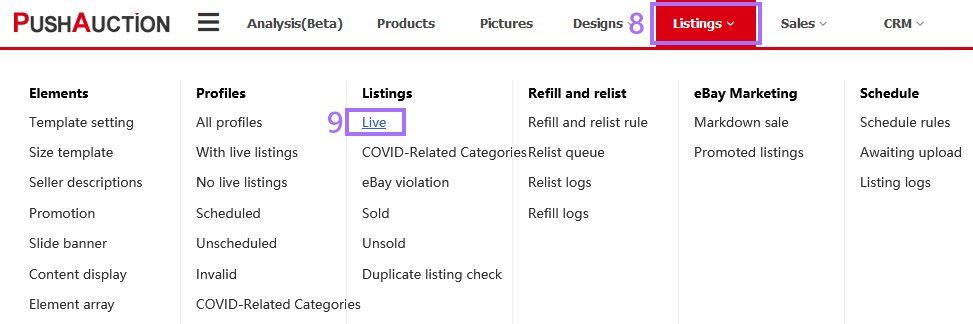

Step 1: Click [Listings] > [Live] > Click [Edit] on the right side;

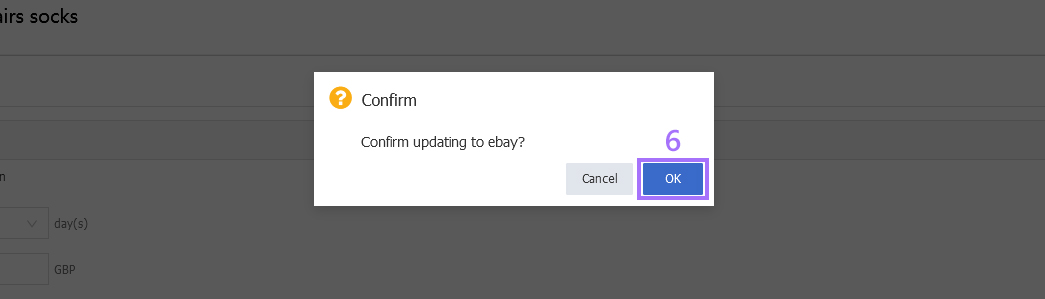

Step 2: In [Price details] section, fill in VAT rate, and modify the price as needed > Click [Update live listings] > Click [OK] in the query dialog box.

Ⅱ. Edit for multiple listings

We encourage you to select the same eBay account and site for updating, and use a special flag to mark completed items.

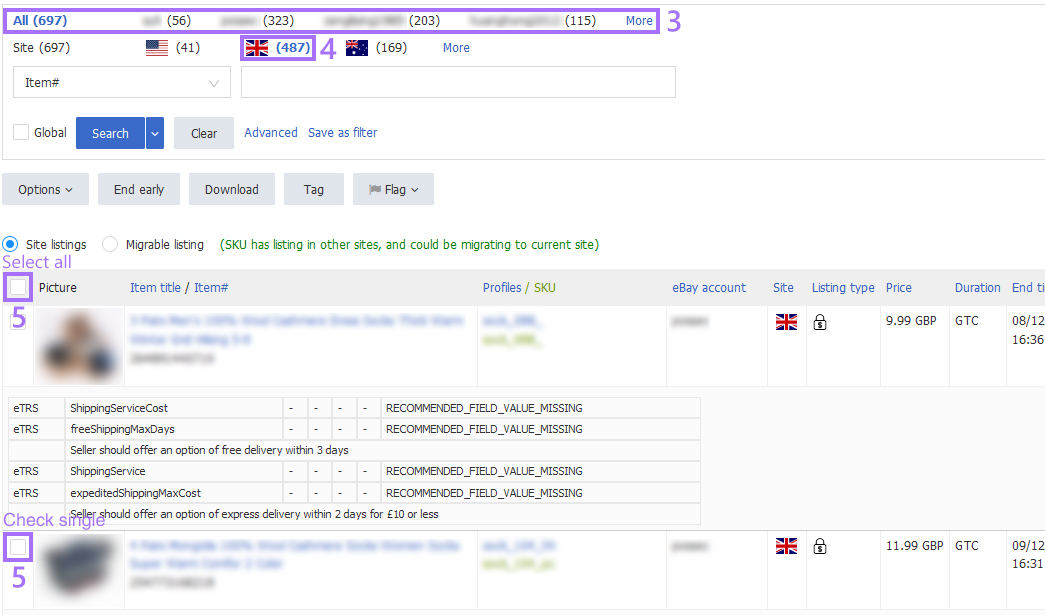

Step 1: Click [Listings] > [Live] > Select the eBay account and site > Check the listings;

Step 2: Click [Options] > [Online edit];

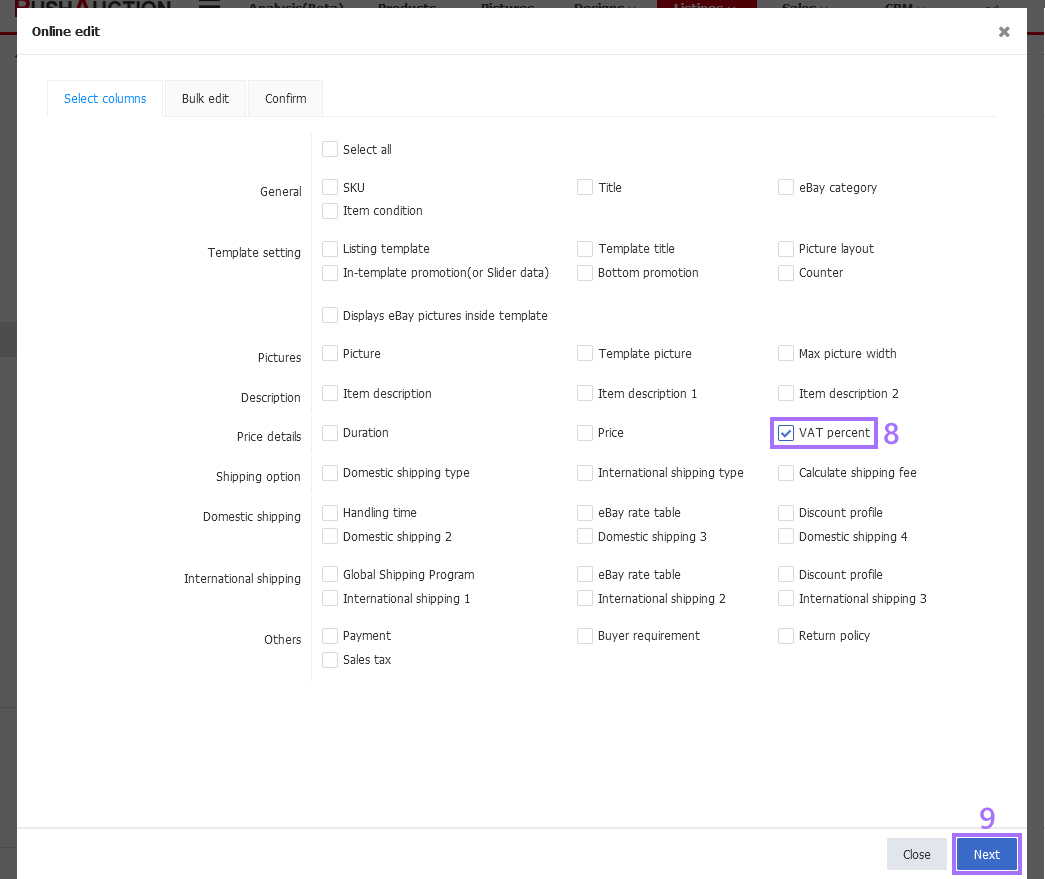

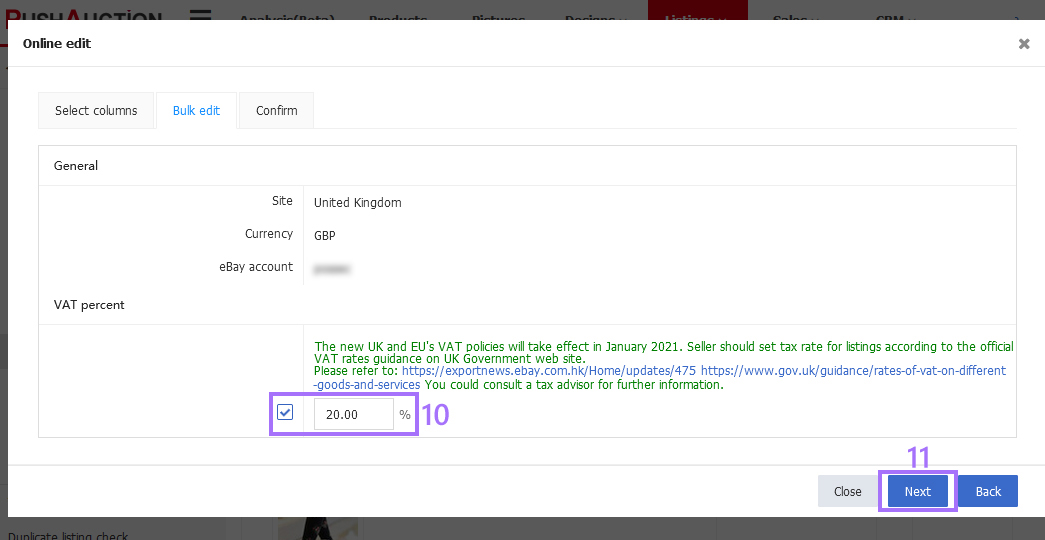

Step 3: In the pop-up window, check [VAT percent] ([Price] can be checked at the same time if you need to modify it) > Click [Next] > Check and fill in VAT rate > Click [Next] > [Update].

Ⅲ. Edit for multiple listings with table

Step 1: Click [Listings] > [Live];

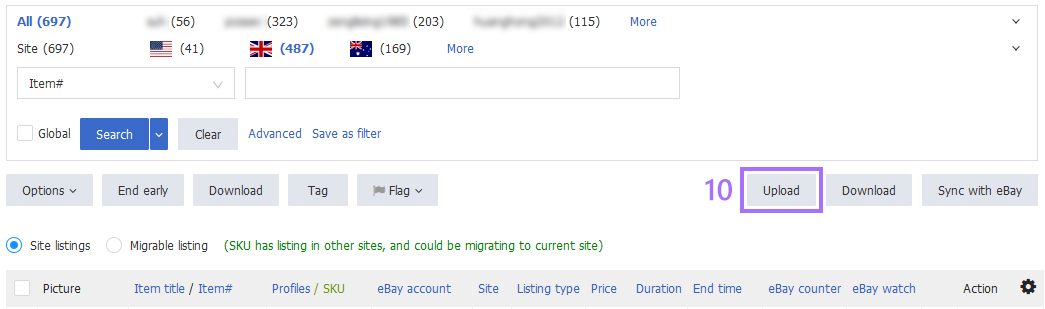

Step 2: Check multiple listings and click [Download], or select the account and site and click [Download];

Step 3: Check [VAT percent] on the download page (If [Price] or other fields need to be modified, you can check them together), click [Download];

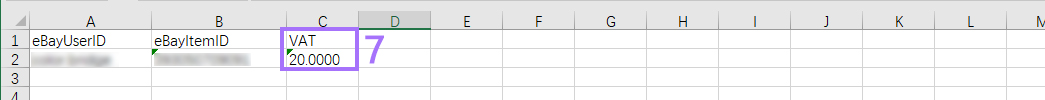

Step 4: Open the downloaded table > Fill in the VAT rate in the [VAT] field > Save as a new document;

Step 5: Click [Listings] > [Live] > [Upload];

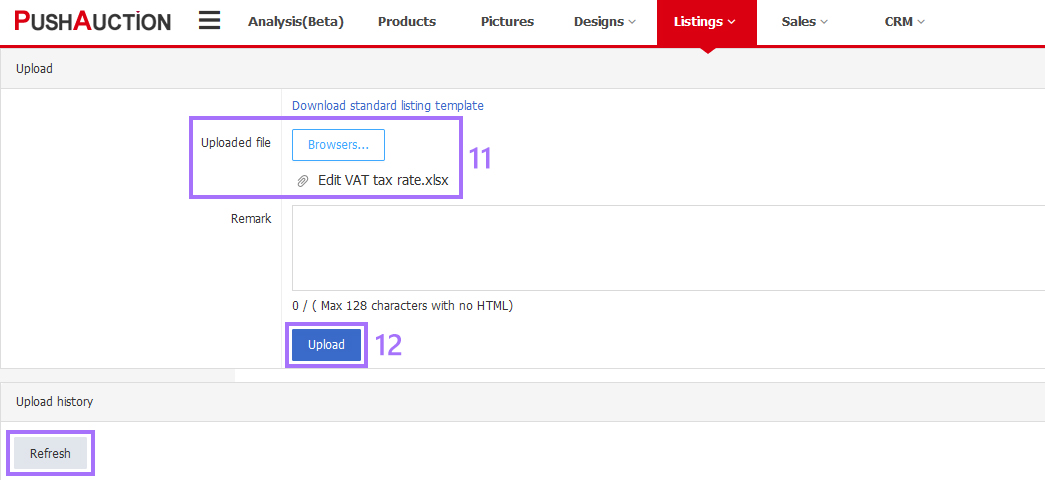

Step 6: Click [Browse] on the upload page > Select target table > Click [Upload].

After submitting the update request, you can click [Refresh] in the [Upload history] field to view the processing progress. When all the listings in the table have completed the update action, you can click [Download result] or [View result] to view the update results.

For more information about Upload and download of live listings, please click here.

Article Number: 1641

Author: Mon, Dec 14, 2020

Last Updated: Wed, Sep 1, 2021

Online URL: https://kb.pushauction.com/article.php?id=1641