How to Use the eBay Sales Tax Table

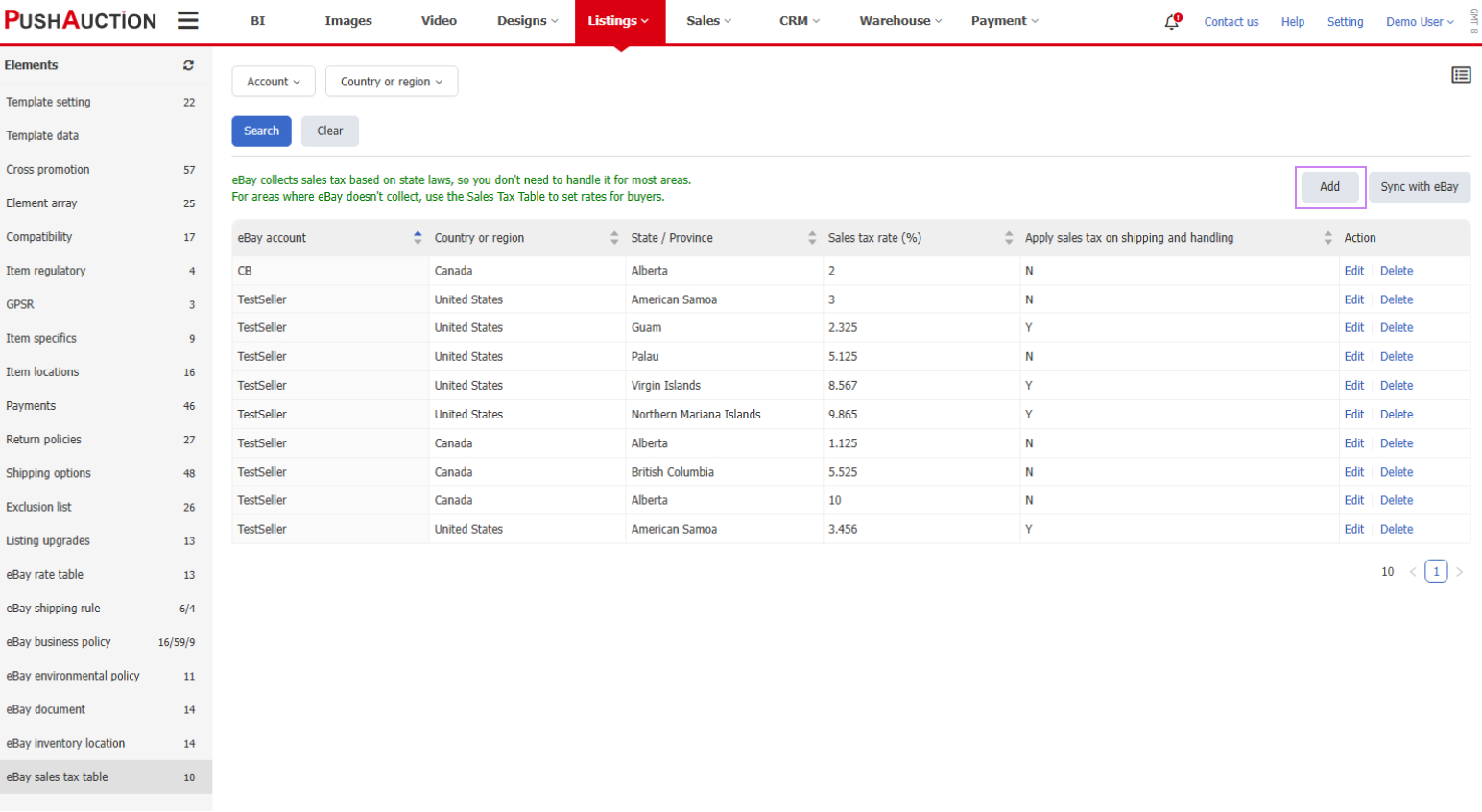

eBay collects sales tax based on state laws, so you don’t need to handle it for most areas.

For areas where eBay doesn’t collect, use the Sales Tax Table to set rates for buyers.

Note: In the US, eBay now calculates, collects, and remits sales tax to the proper taxing authorities in all 50 states and Washington, DC. Sellers can no longer specify sales-tax rates for these jurisdictions using a tax table.

However, sellers may continue to use a sales-tax table to set rates for the following US territories:

American Samoa (AS)

Guam (GU)

Northern Mariana Islands (MP)

Palau (PW)

US Virgin Islands (VI)

American Samoa (AS)

Guam (GU)

Northern Mariana Islands (MP)

Palau (PW)

US Virgin Islands (VI)

For additional information, refer to Taxes and import charges.

How to Create and Use the eBay Sales Tax Table in PushAuction

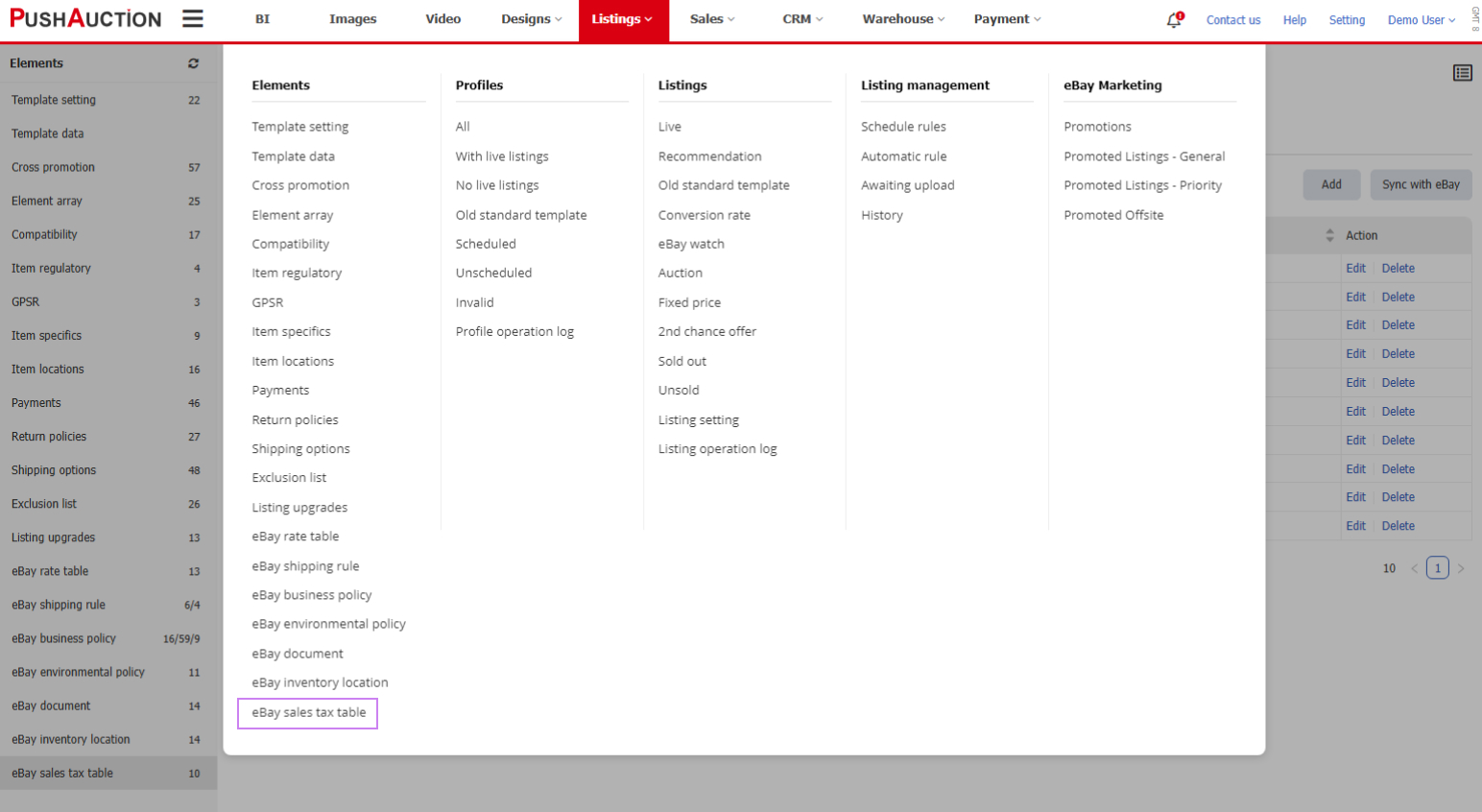

1. Click [Listings] > [Elements] > [eBay sales tax table] in the top menu to access the sales tax management list.

2. Click [Add] in the upper left corner to open the add window.

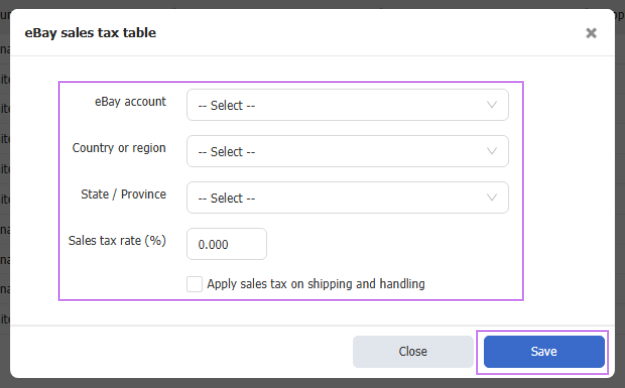

3. In the add window, select the eBay account, country or region, state/province, and set the sales tax rate, then click [Save].

※ If you have already created a sales tax table in eBay, you can sync the data to PushAuction by clicking [Sync eBay] in the upper right corner.

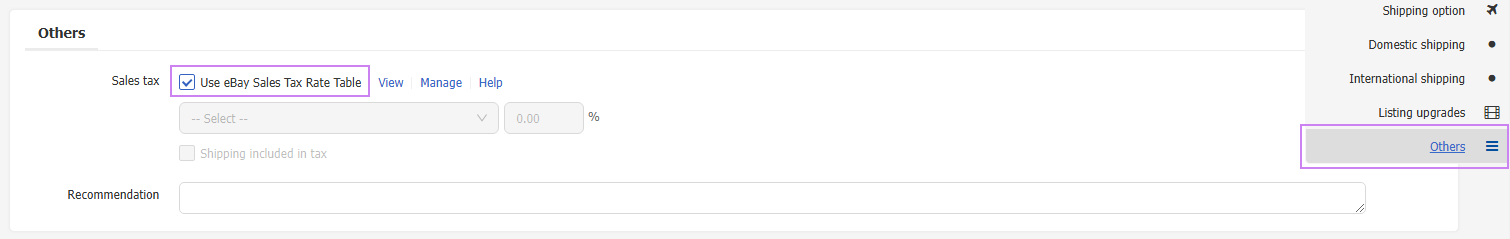

4. Go to the profile/listing editing page. In the [Others] section at the bottom, check the option [Use eBay Sales Tax Table] to apply it.

This article is also available in the following languages:

Chinese Simplified

Chinese Simplified Chinese Traditional

Chinese Traditional